Moving is a big decision and never an easy one; the house

you are in has memories packed to the rafters, good and bad. The children have

gone and the commitment of running a household with surplus rooms is difficult

to manage and maintain. So what are the options?

Firstly, do your research; there are many things to

consider. For example, do you follow

your dream of living by the coast or move near your children? Will you miss the extra space in the house?

can you maintain outside space?

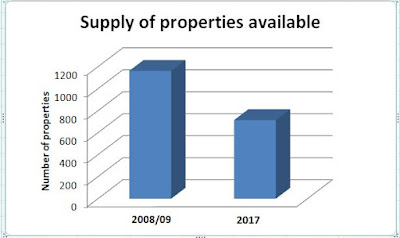

Housing for older people report was

written with this interesting piece of information when looking to downsizing-

“One of the main barriers for older people and pensioners wishing to

sell their family home and relocate is the lack of suitable choices. In June

2015, Legal & General commissioned a report which found that when last time

buyers are looking for a new home, the most common preferences are being close

to family and friends (32%), being near their current neighbourhood (18%),

having easy access to healthcare (16%) and being located near shops (10%).1”

In reality all of these need careful consideration as downsizing

is a major upheaval and there are significant costs involved, so it’s essential

to factor in before you make you move.

Apart from the money you may have collected by selling

your no longer useful house belongings, smaller living spaces are generally

less expensive and incur lower monthly maintenance cost, lower mortgage or rent

payments, lower energy bills and fewer items to fix around your smaller accommodation. It’s no secret that the housing costs take up

a huge chunk off your disposable income and any way to decrease these expenses

will let you have more breathing room when managing your finances.

This is also a good time to get rid of any unwanted

furniture or lots of household items that is no longer required, what needs to

be considered will it fit into your new planned abode? All these items can be either given to charity

or if they are in relatively good condition sold to provide welcome cash

welcome cash injection to help offset the cost of the move.

You’ll not only have to pay estate

agency costs for selling your home, but you’ll also have to pay stamp duty on

your new home, as well as covering removal costs and legal fees. These costs, combined with the stress of a

move, can be too much for many people, who may want to consider alternatives to

downsizing to free up funds from their property.

The easiest way of getting the most

up-to-date information that you need about moving home is to consult a respected,

local professional.

In essence, downsizing doesn’t have to be a hassle or a traumatic

experience and parting with the things you own can definitely be emotional, but

try to think about the life you’ll get in exchange for the things you’re giving

away, I believe the term is ‘Less is more!’

If you’re moving into a smaller accommodation

in the area you’ve always wanted, try to make sure that the new life is as

happy as possible. If you’re downsizing

because you need to save money, think about the money you’ll save and all the

money you have received from selling unwanted goods, use it as an incentive to

never get stuck in a tricky financial position again. Whatever your reasons are, attitude matters

and the more positive you can make the process, the smoother it will go.

1) Communities

and Local Government (CLG) Committee inquiry - Housing for older people Written

submission from NAEA Propertymark March 2017

How Much Is Your Property Worth? Click Here To Find Out For FREE

If you are looking for an agent with experience that can help you find the right tenant for your property, then contact me to find out how we can get the best out of your investment property. Email me on chris@ashmoreresidential.com or give me a call on 020 7435 0420. Pop in for a chat – we are based at Ashmore Residential, 5 Netherby Gardens Enfield EN2 7PA. There is plenty of parking and the kettle is always on.

If you are looking for an agent with experience that can help you find the right tenant for your property, then contact me to find out how we can get the best out of your investment property. Email me on chris@ashmoreresidential.com or give me a call on 020 7435 0420. Pop in for a chat – we are based at Ashmore Residential, 5 Netherby Gardens Enfield EN2 7PA. There is plenty of parking and the kettle is always on.

Don't forget to visit the links below to view back dated deals and Hampstead Property News.