It’s been an interesting and

challenging year for both landlords and vendors. Speaking with several

landlords in the local area, many have expressed concerns about their tenants’

ability to pay and balancing that with the need to have the rental income at least

rise with the rate of inflation. In previous years, rents were rising above

inflation, though wages over the past 12 months have not kept up with inflation

which has risen to 2.9%.

In the peak season of the local

rental market (between June and September) the rents tenants have paid are the

same as in 2016 and that is for properties that have been well maintained,

offered in good overall condition. Over the past year, rents in the Hampstead

area have fallen in real terms by an average of 5.5% at the lower and middle

end of the market. At the upper end, that is primarily geared towards the

corporate sector, has been far more precarious with falls exceeding 10%.

Crucially, we have seen tenants looking at other locations outside of the

Capital for reasons of affordability, and that, in part, has also brought about

the increase in supply, leaving Londoners more choice.

Hampstead landlords have

naturally been a little nervous about the downward trend as there is also the

crucial element of what has been happening to Capital values, which is of interest

to all property owners in the area. Over the past 6 months, the evidence from

the Land Registry for recorded transactions indicates that average property

values (for all property) in the Hampstead area have fallen from £1,603,188 to

£1,377,580. In monetary terms, that is £225,608 or 14%.

We have to also take into

account the seasonality of the property market, with the majority of these

sales having been agreed in the spring and completing in the summer months.

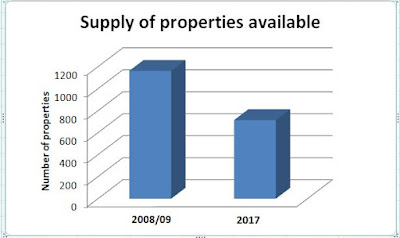

Since the beginning of the year

we have seen an increase in supply of 15% in total number of properties

available to 715, this has slowed house price growth. If you are considering

selling your home, it’s important to remember that your property is on the

market in competition with – not in isolation to all the other homes

on the market- therefore correct pricing is essential. In this information age

society that we live in, everyone has access to every property on the market

and will naturally compare your home with similar ones.

In the medium term, I maintain

the view that the Hampstead property prices will stabilise and gradually

recover. Despite the increased choice for buyers, if we go back a few years to

the recession of 2008/2009, the availability of housing in the area is far less

today than it was then. In 2008 for example, there were 1163 properties offered

for sale in comparison to the 715 currently available. The falling supply of

homes over recent years will help to keep prices relatively high over the

medium to long term.

So what has brought about this

trend? There are a number of variables

in the equation; firstly, fewer people are moving home as frequently, which

means less property for sale. Secondly, Hampstead, like most areas, has a good

proportion of buy to let property. Landlords tend to hold their investments,

selling far less often than owner occupiers, removing property from the market

altogether.

The next issue is the cost of

moving, the revisions in Stamp Duty have made it far more expensive than before

adding to the constraints of buying a home. We are also living much longer

nowadays, therefore owner occupiers are much older and will move less often,

especially as they reach pensionable age. Following on from that, Governments

(past and present) ill thought out Housing Policies mean that we are about 50%

down on the number of new homes that need to be built to address the

supply/demand imbalance. We need around 250,000 built per year; current figures

show a paltry 130,000 or so. Last, but not least, the mortgage rules introduced

back in 2014 mean that lending criteria is far more stringent, limiting the

level of borrowing a person can take on.

This in particular, has had a

significant impact on the Hampstead property market when you consider that the

average house price for a terraced/semi detached home is nearly 5 times the

London average.

To put all this into

perspective, Hampstead homeowners who aren’t planning to sell, the downward

trend in prices is what we see on paper and is a cycle of the current market. To

those who are committed to selling, they are also buyers, therefore, even if

you don’t achieve as much as you may like for your home, the one that you are

buying won’t be as much.

How Much Is Your Property Worth? Click Here To Find Out For FREE

If you are looking for an agent with experience that can help you find the right tenant for your property, then contact me to find out how we can get the best out of your investment property. Email me on chris@ashmoreresidential.com or give me a call on 020 7435 0420. Pop in for a chat – we are based at Ashmore Residential, Suite 7, 25-27 Heath Street, London, NW3 6TR. There is plenty of parking and the kettle is always on.

If you are looking for an agent with experience that can help you find the right tenant for your property, then contact me to find out how we can get the best out of your investment property. Email me on chris@ashmoreresidential.com or give me a call on 020 7435 0420. Pop in for a chat – we are based at Ashmore Residential, Suite 7, 25-27 Heath Street, London, NW3 6TR. There is plenty of parking and the kettle is always on.

Don't forget to visit the links below to view back dated deals and Hampstead Property News.

Great post on property buying! really appreciated the tips on budgeting and finding the right location.

ReplyDelete